A car is one of the most expensive purchases you can make. Assuming you don’t have the cash on hand to outright buy a car, there are still several options available to you when it comes to financing your purchase. Many people choose to take out a loan from a bank or other financial institution, while others may opt for dealer financing. There are many reasons why you might need to finance a car. Perhaps you don’t have the cash on hand to pay for the vehicle outright, or maybe you’re looking to get a lower interest rate than what your bank is offering.

When you finance a car, you’re essentially taking out a loan to cover the cost of the vehicle. This loan will need to be repaid over time, usually in monthly installments. The amount you’ll need to pay each month will depend on the size of the loan and the interest rate. Be sure to compare offers from multiple lenders before making a decision.

Figuring out the budget to buy your dream car

It is important when financing a car to figure out your budget. With a little planning and research, it can be done relatively easily. The first step is to determine how much money you can realistically afford to spend on a car. This includes not only the purchase price of the vehicle, but also taxes, fees, insurance, fuel, and maintenance. Once you have an idea of your budget, you can start looking for cars that fit into that price range. Next, you need to decide whether you will pay cash for the car or finance it. If you plan to finance, find out how much money you can borrow and what your monthly payments will be. Once you have figured out your budget and financing, you can start shopping for cars! Be sure to do your research before making a purchase. Compare prices, features, and reviews to find the best car for you. With some preparation, figuring out the budget to buy your dream car can be easy!

What are the best ways to finance a car?

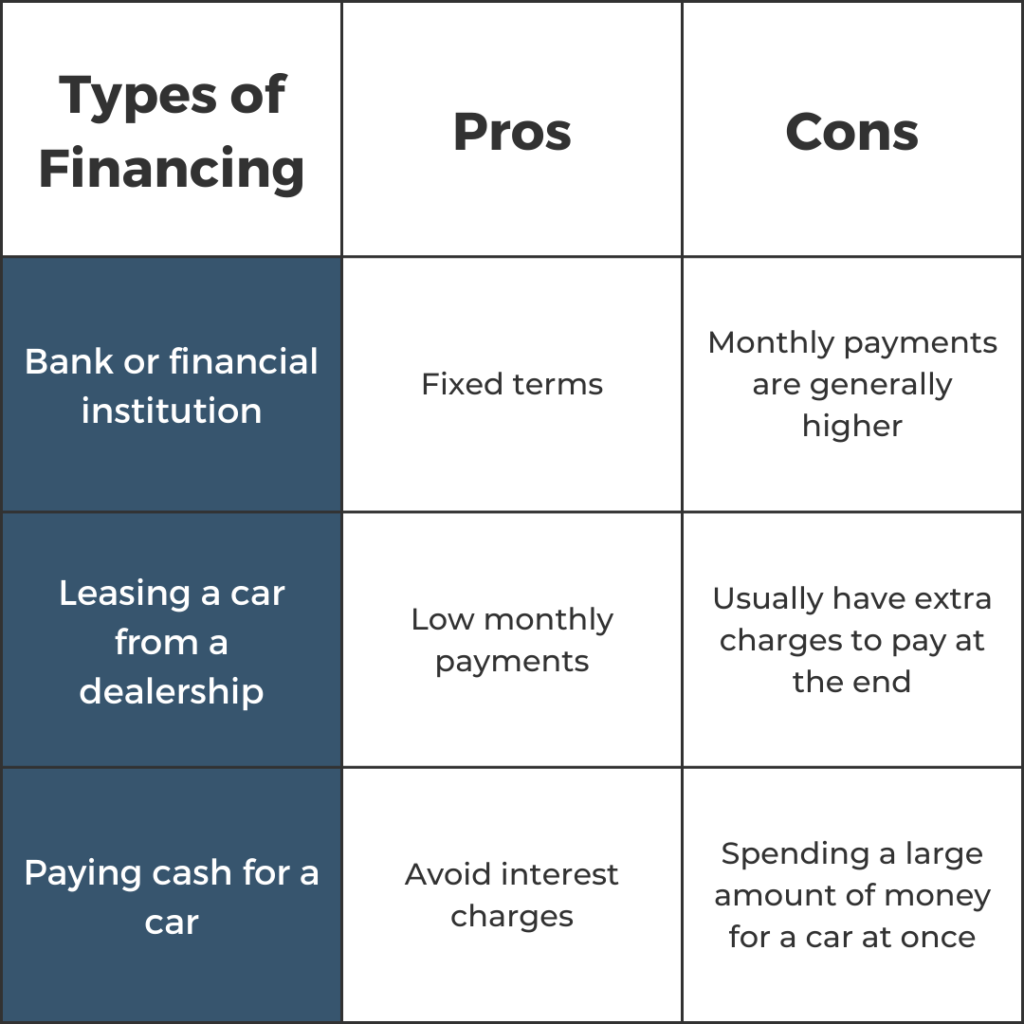

There are a few different options to finance a car. Each of the following options has its own pros and cons that you should consider before making a decision.

Can I use a personal loan to buy a car?

The quick answer is yes, you can use a personal loan to finance the purchase of a car. When you finance with a personal loan:

– You can shop around for the best interest rate

– You can spread the cost over a set period

– You can choose your own repayment terms

– You avoid dealer markups:

– You can pay off the loan early without penalty

How does car financing work?

Car financing is the process of borrowing money from a financial institution to purchase a car. The interest rate you pay on the loan will depend on many factors. If you have good credit, you may be able to qualify for a low-interest loan. However, if your credit is less than perfect, you may end up paying a higher interest rate. The length of the loan term will also affect your interest rate. A shorter loan term will typically have a lower interest rate than a longer loan term.

There are two main types of car loans: secured and unsecured. A secured loan is backed by collateral, such as your car’s title or a down payment. An unsecured loan is not backed by any collateral and typically has a higher interest rate.

If you’re looking to finance a car, make sure you shop around for the best interest rates and terms before signing any paperwork.

What is a healthy credit score to finance a car?

A healthy credit score is generally considered to be anything above 650. However, this number can vary depending on the lender you use. The best way to determine what credit score you need is to check with the lender you plan to use ahead of time. This way, you’ll know what their requirements are and can work on boosting your score if necessary.

Financing a car with a personal loan is becoming increasingly popular because of low rates, quick and easy process and more flexible terms. This means that you can get the money you need to buy your car sooner. Finally, personal loans can be used for any purpose, including buying a car. This flexibility can be helpful if you’re not sure what type of loan you need. If you’re considering financing your next car with a personal loan, be sure to compare rates and terms from multiple lenders to get the best deal.