Home renovations are a great way to add comfort and style to your home. There are many reasons why homeowners renovate their homes, but the most common reason is to increase the resale value of their property. According to the Home Stars, Canadian homeowners are now more than ever investing more of their cash on hand into home renovations. If you are thinking about renovating your home, it is important to know what type of renovation you want. Do you want to add an addition to your home? Or perhaps you want to renovate your kitchen or bathroom. Once you know what type of renovations you want to do, you can set a budget for it. Home Renovations with a Home renovation loan can be a great way to add value to your home, but they can also be expensive. If you’re planning on doing any major renovations, it’s important to think about how you’ll finance them.

What type of home renovation is eligible for financing?

If you’re planning on undertaking a home renovation, there’s a good chance that you’ll need to take out a loan to finance the home renovation. But did you know that not all home renovations are eligible for financing? Here are 5 examples of home renovations that are eligible for a loan:

1. Replacing your roof

2. Upgrading your windows and doors

3. Adding or renovating a bathroom

4. Finishing your basement

5. Renovating your kitchen

These are just a few examples of home renovations that may be eligible for financing through a loan. Your specific renovation project may also be eligible, so it’s always worth checking with your lender to see what options are available to you.

How to finance major home renovation

There are a few ways to finance your home renovation. The most common way is through a loan from the bank or other financial institution. You can also use credit cards, home equity lines of credit, or even personal loans from family and friends. If you’re planning on using a loan to finance your renovation, it’s important to shop around for the best interest rate and terms. Be sure to understand the lender’s terms and ensure you are eligible for the loan before you start any work. If you’re not sure how much money you’ll need to borrow, start by getting a quote from a contractor or estimator. Once you have an idea of the total cost, you can start looking around for loans. Whatever method you choose to finance your renovation, be sure to budget carefully and make all payments on time. By planning and being mindful of your spending, you can ensure that your home renovation is a success.

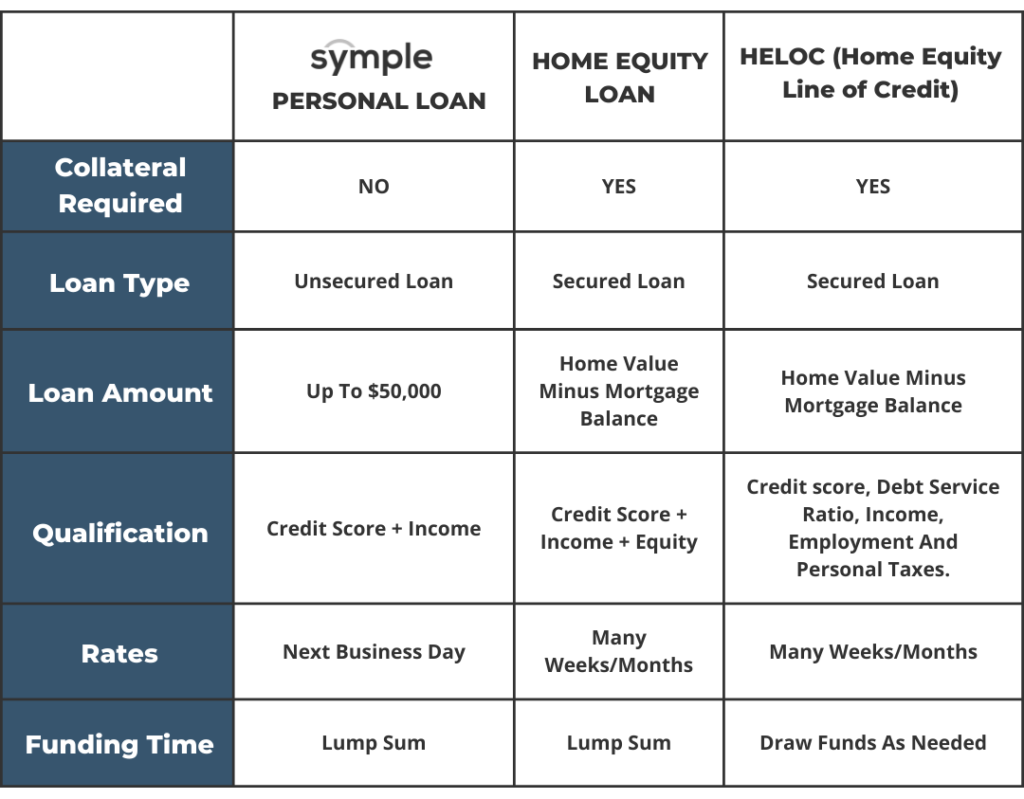

Home Renovation Loan vs. Home Equity Loan vs. Home Equity Line of Credit

There are a few key differences between home renovation loans, home equity loans, and home equity lines of credit that you should be aware of before you decide which one is right for you.

Why should you finance your home renovation with Symple Loans?

Symple Loans has helped many people reach their home renovation dreams with their low interest rates. With an easy and simple loan process you can submit your application in minutes from anywhere, anytime. Symple offers loans anywhere from $5,000-$50,000 to help finance any size projects. Symple’s flexible terms allow for loan repayment for up to 7 years with bi-weekly, monthly, or bi-monthly payments, with no fees for early repayment. Symple makes it easy to stay on track with your goals and get the most out of your budget.

When is home renovation financing a bad idea?

If you’re considering financing a home renovation, make sure you understand all the potential risks and costs involved first. There are a few situations when it’s generally not a good idea to finance a home renovation. If you are facing financial difficulties, taking on more debt is probably not going to help your situation. To avoid a default, make sure you only borrow an amount you know you can pay back and ensure that you have a plan in place to make your payments on time. Additionally, if you miss any payments on the loan, you could end up damaging your credit score. If you’re not sure you can commit to making regular payments, it’s best to avoid taking out a loan. Home renovation loans can be a great way to improve your home, but only if you’re financially prepared to handle the additional debt.

Resources

homestars.com/reno-report/