Unsecured loans are a type of loan that doesn’t require any collateral (such as property or asset) to be used as security against the loan. Instead, the borrower is responsible for repaying the loan amount, plus interest and fees, on time and in full. Unsecured loans can help individuals pay for large purchases or debt consolidation and can typically be used for any purpose.

When to consider an Unsecured Personal loan?

When a borrower needs money quickly and doesn’t have the collateral to secure a traditional loan, an unsecured personal loan may be the right choice. Unsecured Personal loans are typically more accessible than secured loans since there is no need for collateral or a lengthy approval process. Unsecured personal loans can also be cheaper than other types of borrowing, such as credit cards.

What is an Unsecured loan?

An unsecured loan also known as a unsecured personal loan is a loan that doesn’t require you to put up any collateral or security. This means that if you can’t repay the loan, the lender can’t seize or repossess your assets. An example of this would be your credit card an unsecured loan is a loan extended without the need for any collateral. It is supported by a borrower’s strong creditworthiness and economic stability. If borrowers default on the loan, they can face strict actions like a poor loan credit score, collection agents or legal actions.

What are the Types of Unsecured Loans

Let us take you through major examples or types of unsecured loans.

Unsecured Personal Loans

Unsecured personal loans are generally used for larger purchases, such as debt consolidation or home improvements. These types of loans require no collateral and can be offered with fixed or variable interest rates. For example, an individual might take out an unsecured loan to consolidate existing high-interest credit card debt into a single monthly payment with a lower interest rate.

Payday Loans

Payday loans are short-term, unsecured loans with extremely high-interest rates. These loans are typically used for emergency expenses and are due on the borrower’s next payday after taking out the loan. For example, an individual may take out a payday loan to cover unexpected medical bills or car repairs that cannot wait until their next paycheck.

Credit Cards

Credit cards allow borrowers to take out a loan up to their available credit limit and make purchases with it. Most credit cards have variable interest rates depending on the type of card and the borrower’s credit score and how the borrower successfully pays their credit card debt. Interest rates can be as low as 0% for introductory offers or as high as 30%. Borrowers should be aware that credit card debt can quickly accumulate, particularly if they carry a balance from month to month.

Personal Lines of Credit

Personal lines of credit are another type of unsecured loan that allows borrowers to access funds up to a certain limit. These loans typically offer more flexible repayment terms than other types of borrowing and can be used for any purpose. They often provide the convenience of having money readily available when needed, without the need to reapply each time additional funds are required.

Peer-to-peer loan

Peer-to-peer loans are a type of unsecured loan where the borrower is connected with individual lenders through online platforms. These loans usually offer lower interest rates than traditional lenders and can be used for any purpose. For example, an individual might take out a peer-to-peer loan to cover the costs of home improvement projects or medical expenses.

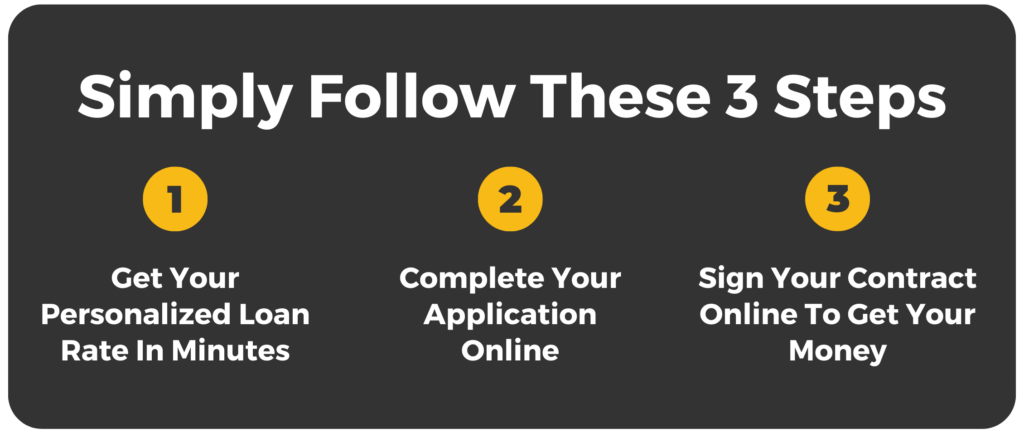

3 Easy Steps to Get an Unsecured Personal Loan

- Get your personalized loan rate in minutes. Answer a few questions online and in less than 2 minutes you will have your personalized loan rate offer.

- Confirm your details and submit an application online

- Loan Approval and Disbursement: If your loan application is approved, the lender will provide you with a loan agreement that outlines the terms of the loan. Once you have signed and returned the agreement, the money will be disbursed directly to your bank account or other designated account. It is important to understand all of the terms and conditions of your loan before signing any documents. After the loan is disbursed, you should begin making your payments according to the agreed-upon repayment schedule.

Symple Loans Personal Loans

If you are looking for an unsecured personal loan, Symple Loans is your answer. Symple offers

- Loans up to $50,000

- Rates* start at 6.99%

- Terms up to 7 years

- Funding the next business day

- A quick AND easy online application process

Is an Unsecured loan the right option for me?

Ultimately, the decision to get an unsecured personal loan should be made after carefully considering your financial situation. Secured and unsecured loans can provide quick access to funds without having to put down any collateral. By taking the time to find the right loan for your needs, you can secure the funds that you need without compromising your financial future.

Where Can I Get An Unsecured Loan?

An unsecured loan can be obtained from almost any type of lender in Canada, from banks and credit unions to direct online lenders. Depending on what type of borrower you are and the types of features you’re looking for, you should have no trouble finding multiple loan options to meet your needs.