Feeling burdened by debt and seeking ways to alleviate financial strain? With car loans being one of the most common forms of debt, finding a way to pay off car loans early can bring numerous benefits, including potential interest savings and increased financial freedom. In this article, we’ll discuss the difference between a car loan and a personal loan, the pros and cons of paying off your car loan with a personal loan, and when would be the best time to do this.

Can you pay off your car loan early in Canada?

Absolutely! You have the flexibility to pay off your car loans early in Canada before the designated term ends. Whenever Canadians receive a raise, come into extra cash, or simply wish to eliminate debt, they may choose to pay off their car loans early. It offers benefits such as:

- Saving on interest payments over the full loan term.

- Removing a monthly payment from your budget, providing more financial freedom.

- Moving to an unsecured loan

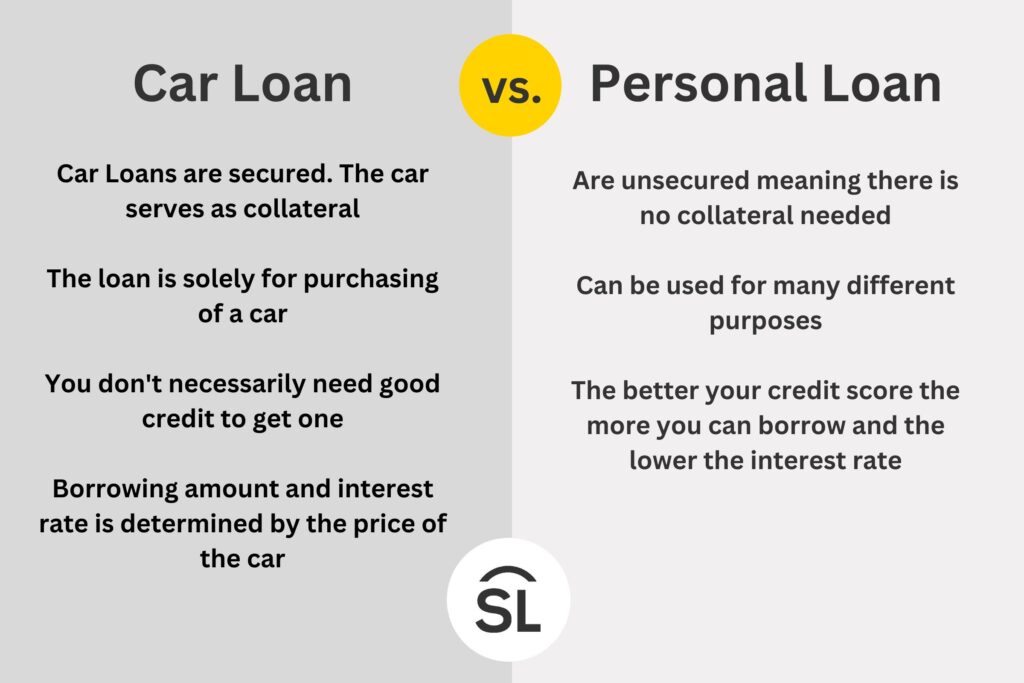

Car Loan vs Personal Loan: What is the Difference?

Personal loans, on the other hand, can be used for a variety of purposes. They are unsecured loans, which means that you do not need to provide collateral to secure the loan. The interest rate on the personal loans is based on the applicant’s credit score and financial circumstances. Having a good credit score for a car loans helps you get a loan with a less interest rate as well.

Pros of Using a Personal Loan to Pay Off a Car Loan

- Longer Terms: Personal loans offer longer terms up to 7 years and car loans often offer terms up to 6 years. This means that you have more time to pay off your loan.

- Lower Monthly Payments: having a longer term means the amount of the loan is spread out over a longer period of time making your monthly payments less.

- Flexibility: Personal loans can be used for a variety of purposes, including paying off your car loan early. This gives you more flexibility in how you use the funds.

- Debt consolidation: Personal loans can help you consolidate your debts into one monthly payment, which can make it easier to manage your finances.

- No collateral: Personal loans are unsecured, which means that you do not need to provide collateral to secure the loan.

Cons of Using a Personal Loan to Pay Off a Car Loan

- Higher Interest Rates: Personal loans may have higher interest rates than car loans. This may be based on the applicants credit history. Whereas a car loan uses the car as collateral, the peronsal loan has is unsecured and has no collateral making the transaction risky for the lender.

- Higher credit score requirements: Personal loans may require a higher credit score than car loans. If your credit score is not high enough, you may not qualify for a personal loan.

When to Use a Personal Loan to Pay Off a Car Loan

If you are struggling with the monthly payments on your car loan and your credit score has improved since you first took out the car loan, then a personal loan may be a good option for you. If you are paying a higher-than-usual interest rate, paying off car loan early could save a significant amount of interest over the term. If you have a significant period of time to go before the term would end naturally, paying it off early could definitely be a good idea.

Also, if you have multiple debts, you can use a personal loan to consolidate all of them into one monthly payment. This will help you keep track of your finances and reduce the stress of managing multiple payments.

Be sure to check the fine print of your car or auto loan for any fees or penalties for early repayment before making a decision.

7 Simple Steps to get a Personal Loan to Pay off your Car Loan

Do you need to pay off a car loan but don’t know how to pay off your car loan? You may be surprised to learn that getting a personal loan is one of the most popular methods for financing auto purchases. Not sure where to start or what steps are involved in borrowing money for this type of purchase? Don’t worry, we have put together 7 simple steps that will help you get a personal loan and take care of your vehicle needs without breaking your budget. So, keep reading and make sure you’re prepared with everything needed before applying for your new loan!

How to Apply for a Symple Loan

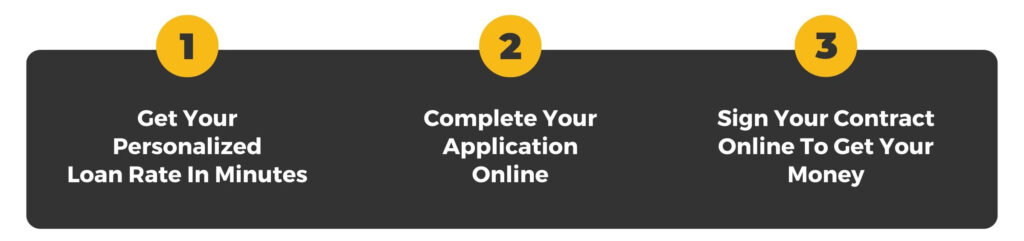

Applying for and getting a personal loan is as quick and easy. You can complete a quick quote online in less than 2 minutes to get your personalized loan rate. For This you will need:

- How much money you would like to finance

- How long you would like to finance for, known as your loan term

Then simply go online and start your application. It’s quick and easy and only takes 3 simple steps.

It’s important to know that this will not affect your credit score this is because when we check your credit score, we do a soft credit check. Symple will notify you of the credit decision via email and if approved you will receive your loan offer for review. Select your offer and confirm your details and financial information via our secure partner, Flinks. The funds will be deposited into your bank account. In order to repay the loan, you can set up an automatic payment plan to make timely payments according to your chosen payment schedule –weekly, bi-weekly, or monthly.

In Summary

Using a personal loan to pay off your car loan can be a good option if you are struggling with the monthly payments, your personal loan interest rate is lower than your car loan rate, and your car loan has a significant amount of time remaining. However, it is important to carefully read your existing car loan contract to review any fees or penalties for early termination. Also, consider the pros and cons of using a personal loan before making a decision. If you do decide to use a personal loan, make sure to shop around for the best interest rates and repayment terms.